What if we told you that you can invest your money in the S&P 500 with no possibility of loss? If the stock market goes up, you get to participate in market gains and if the market goes down, you get your full initial investment back. This is the usual pitch for a structured product known as a Principal Protected Note (PPN).

On the surface, PPNs sound quite appealing. The reality is that investors in PPNs are at a disadvantage. Because it is difficult to understand the fair value of the bargain, investors tend to pay more for PPNs than they are worth. There are other risks and drawbacks as well. Because investors in PPNs can pay too much, PPNs are a nice source of profits for the banks and brokers involved in the issuance and marketing of these notes.

What is a PPN?

A Principal Protected Note is a debt security typically issued by a financial institution. No interest is paid on the debt. In lieu of interest, the investor participates in the gains, if any, on a designated reference security. If the designated reference security does not go up in value, the full original principal is returned to the investor without interest. If the reference security rises in price, the investor gets back the original principal plus participation in the gain on the reference security, in accordance with the terms of the Note.

Example of a PPN

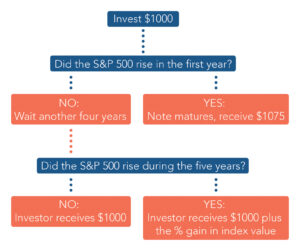

A PPN being issued by one of the largest US banks was pitched to us this month. It is a five-year Note, with an asking price of $1000 per Note, and the S&P 500 US stock index as the reference security. If the S&P 500 index goes up in the first year, the investor will receive their $1000 back at one year, plus $75. Otherwise, the Note stays outstanding four more years, at which time the investor gets their $1000 back, plus the percentage gain, if any, in the S&P 500 index over the five-year period.

Bankruptcies of large US banks are rare, so there’s a high probability of at least getting one’s money back. Moreover, the investor can participate in future gains in the US stock market. As described here, this PPN sounds enticing. What’s the catch?

Investors Pay Too Much

PPNs are complicated products. To calculate the fair value of the PPN in our example, one would have to judge, among other things:

- The cost of funding for the issuing bank

- The cost today of providing a 7.5% payoff if the S&P 500 rises in year one

- The cost one year from now to provide the potential upside participation at year five, if the S&P 500 falls in year one

It is highly unlikely that a prospect for this investment would have an accurate understanding of its actual value. In fact, the offering document implies that investors might be getting fleeced: “[The bank] currently expects that the estimated value of the notes on the pricing date will be at least $850.00 per note, which will be less than the issue price.” Perhaps the bank is counting on prospects not reading or understanding the fine print – why would anyone pay $1000 for something worth $850?

In this case, the bank is being deliberately scary. The theoretical fair value of this Note is better than $950. Even so, the $1000 being asked represents a premium of up to 5% over fair value, putting the investor at a disadvantage. The bank gets the benefit of having investor money for as much as five years without paying any interest, and that is more valuable to them than the cost of offering investors the potential upside participation in the S&P 500 index.

Other Drawbacks of PPNs

Default Risk – PPNs as presented seem to remove risk from the decision process, but that’s not the case. Investors in PPNs are exposed to the credit risk of the underlying sponsor. For instance, Lehman Brothers was an active issuer of PPNs before the Global Financial Crisis. When Lehman Brothers went bankrupt in 2008, its PPN investors became unsecured creditors in the tortuous bankruptcy process for Lehman which continues to this day. The broker dealer who sold the Lehman notes was fined and forced to pay restitution for misleading investors about how “protected” their investment would be.

Taxes – For a taxable US investor in PPNs, the Original Issue Discount (OID) tax rules may apply. The OID rules require an investor to pay tax based on the interest rate that could have been received on similar issues at the same time. This makes the PPN bargain worse for a taxable investor than it would be for a tax-exempt investor. The taxable investor will have additional cash outflows – taxes on the “interest” which they are not receiving – before any inflows are received from the issuer.

Liquidity – PPNs are not listed on any exchange, and the secondary market for them is not very liquid. If an investor wishes to sell a PPN before maturity, the bank that issues the PPN will usually be willing to buy it back. But documents for a PPN warn that the price the bank would offer to repurchase the PPN would be below the bank’s own calculation of fair value. Even though principal is guaranteed, between purchase and maturity, the fair value of the PPN can swing widely based on changes in stock market prices, interest rates and the credit quality of the issuer.

Regulation of PPNs

The Securities and Exchange Commission and other US regulators offer rather tepid general advice about PPNs, such as “note the terms of your investment.”[1] FINRA, the Financial Industry Regulatory Authority, has issued a Regulatory Notice about the obligations of those who sell PPNs[2]. Notably, the FINRA Notice obliges those who market PPNs to: “make every effort to make customers aware of the pertinent information regarding the products.”

We believe the most important pertinent information about the Note we reviewed would be a clear and accurate explanation of what it is worth. We dug through the two-page term sheet, the 10-page pricing supplement and the 50-page product supplement, without further illumination about that.

Summary

When it comes to PPNs, the issuer has an information advantage. The issuer knows the actual fair value of the PPN, and the investor does not. Issuers can profit by exploiting their information advantage, at investor expense. Caveat emptor! We believe the safe course for investors is to say no to PPNs unless the terms fit their liquidity and risk profile, and they can verify from a sophisticated independent source that the deal is fair.

[iee_empty_space type=”vertical” height=”10″ width=”10″ hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” /]